LandBaron.ca

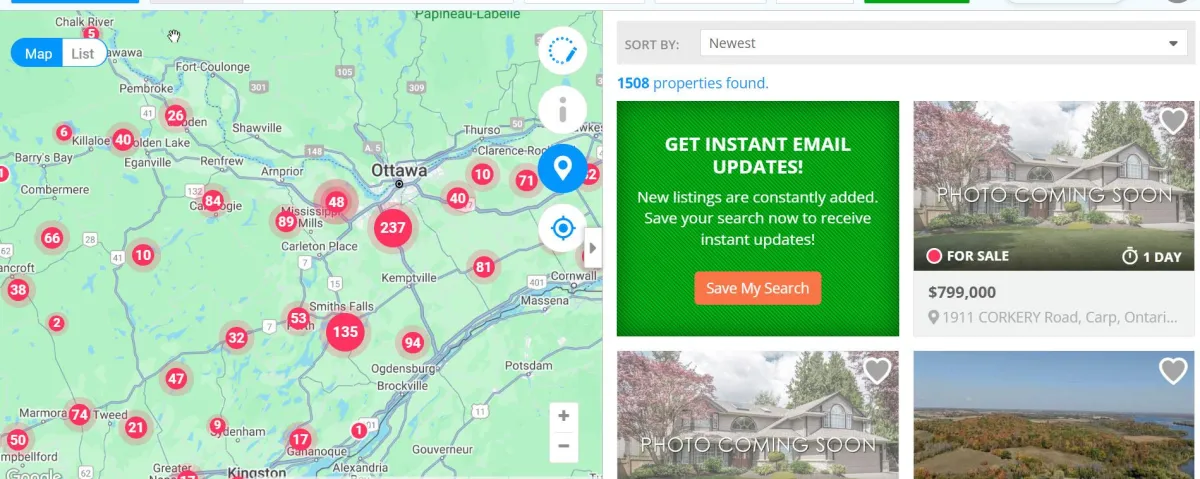

Vacant Land, Development Properties, Farm (AG), Recreation

Residential & Commercial

"Buy Land They're Not Making It Any More"

Mark Twain

Creating Real Value In Property And Places

Lorem ipsum dolor sit amet, consectetur

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Integer convallis nisi interdum, maximus libero non, blandit erat. Fuscenon iaculis ante. Etiam enim velit, mattis eu sapien ac, condimentum consequat justo. Aenean bibendum urna nulla.

Hear From Our Clients

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Pellentesque nec mauris venenatis, aliquam tortor in, commodo metus. Quisque sodales viverra diam, eu

★★★★★

David Doe

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Pellentesque nec mauris venenatis, aliquam tortor in, commodo metus. Quisque sodales viverra diam, eu

★★★★★

David Doe

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Pellentesque nec mauris venenatis, aliquam tortor in, commodo metus. Quisque sodales viverra diam, eu

★★★★★

David Doe

LandBaron.ca

Also contact us about financing options

List Your Property On LandBaron with 100s of daily visitors

This reseorce is made available by Bryon Bertrim Realtor Sotheby's International Canada